Unraveling the Complexities of Forex Trading

Key Takeaways

- Forex trading encompasses currency value fluctuations and daily transactions over $6 trillion.

- The allure lies in high liquidity and the ability to trade 24/5.

- Forex trading is essential for global economic activities, influencing international trade.

- Muslim traders must navigate forex within the framework of Islamic finance principles.

- A fatwa provides guidance on how to align trading practices with Islamic law.

Table of contents

Forex trading, often referred to as FX trading, provides traders the opportunity to profit from fluctuations in the value of currencies. Each day, over $6 trillion in transactions occur in the forex market, making it the most voluminous financial market globally. For more insights and strategies related to Forex trading, you can visit our comprehensive blog post “In-Depth Guide to Navigating Japan’s Forex Market”.

For investors, the allure of forex trading is twofold: the abundance of liquidity and the possibility of trading around the clock. With opportunities present at every tick of the market, astute investors have a plethora of profitable trades at their disposal.

Aside from being a vehicle for potentially lucrative trades, forex trading also plays a crucial role in supporting global economic activity. It is the backbone of international trade and investment, as currencies need to be exchanged for goods and services to flow across borders. Consequently, the significance of forex trading extends far beyond individual profits and into the broader economic landscape.

Forex Trading Within the Lens of Islamic Finance

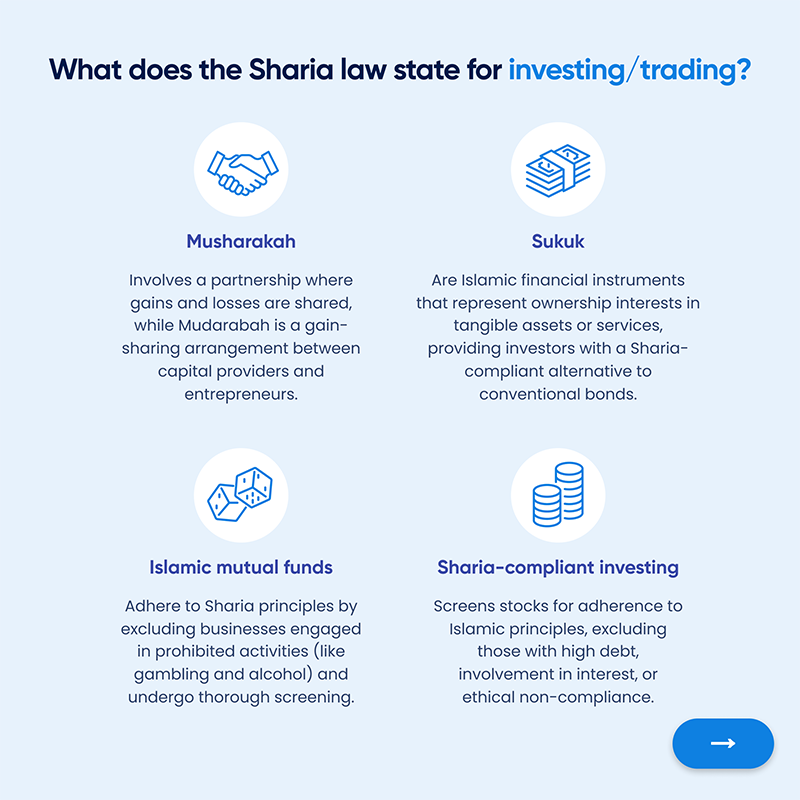

For Muslim traders, the implications of engaging in forex trading extend into the realm of their faith. According to Islamic finance principles, financial transactions should adhere to specific religious mandates. Notably, these include a prohibition against usury or interest (Riba), a requirement for assurity in transactions (Gharar), and a prohibition against gambling (Maysir).

As such, compliance with Islamic financial principles serves two critical purposes. Firstly, it helps preserve the integrity of one’s faith by ensuring that monetary transactions are in line with religious directives. Secondly, it promotes ethical standards within the world of finance.

Should you want to deep dive into this topic, kindly refer to our blog post “PAMM MAM Halal Islam: A Comprehensive Guide to Navigating Forex Trading and Islamic Finance Principles”, where you will find extensive information and guidelines.

The Role of a Fatwa in Guiding Financial Practices

A fatwa is an important tool within the Islamic faith that provides guidance on practical issues. It’s a legal interpretation or ruling given by a qualified Islamic scholar, providing counsel to Muslims on various aspects of life, including finance.

A comprehensive understanding of how a fatwa applies to forex trading is essential for traders seeking to maintain the compatibility of their financial activities with their faith. By exploring the nuances of a trading fatwa, Muslim traders can better understand how to navigate the world of forex trading.

Frequently Asked Questions

What is forex trading?

Forex trading refers to the exchange of currencies in the foreign exchange market, aiming to profit from changes in currency values.

Is forex trading halal?

The permissibility of forex trading in Islamic finance depends on adherence to the principles of Sharia, including the avoidance of riba, gharar, and maysir.

How does a fatwa affect forex trading?

A fatwa provides a framework or guidelines on how Muslim traders can legally and ethically conduct forex trading in accordance with Islamic law.